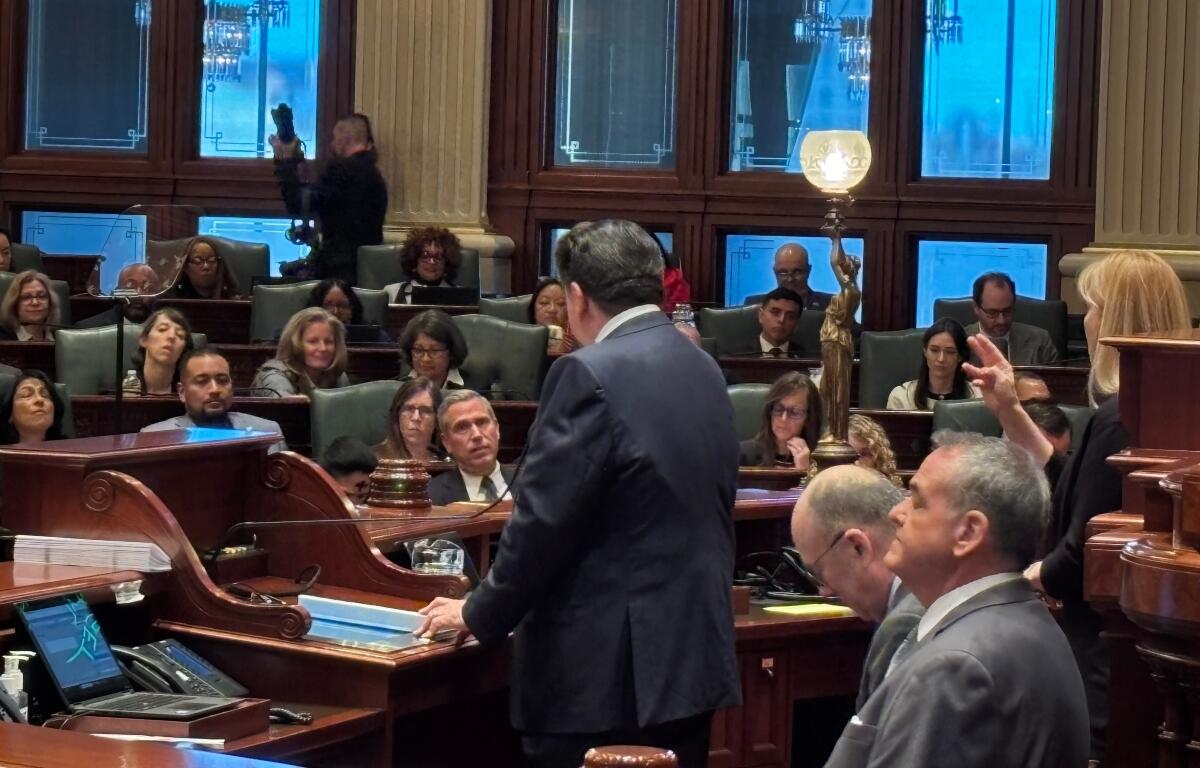

Springfield, IL (CAPITOL CITY NOW) – Here is how local lawmakers and some organizations are reacting to Governor JB Pritzker’s State of the State and Budget address Wednesday afternoon, heard live on WTAX and CapitolCityNow.com (in no particular order):

“This is once again the largest spending plan in state history. Illinois families are already facing high property taxes and a rising cost of living, and this budget does very little to help them. While there are some positive components within this budget proposal, like the restoration of diverted funding to downstate road projects and the plan to expand nuclear energy production in the state. However, the road fund restoration wouldn’t be needed if the Governor and his allies hadn’t taken funding meant to improve downstate roads and bridges in order to bail out Chicago’s failing transit system in the first place. In addition, higher education funding continues to be presented as increasing, yet in reality, colleges and universities are effectively receiving fewer real dollars than they did just a few years ago under this proposed budget. As we move through the budget process, I will continue to advocate for a responsible and sustainable plan that truly supports Central Illinois families.” — State Sen. Sally Turner (R-Beason)

“Once again, Governor Pritzker proposed the biggest budget in the history of our state. It’s the same tired playbook from the Governor. He blames everything on the federal government, his budget is unbalanced by hundreds of millions of dollars, and he’s again proposed a multitude of new taxes and one-time gimmicks. While the Governor says he is serious about lowering energy prices, it’s his policies that have driven power bills through the roof. Don’t believe me? Just compare what’s happened to our rates versus the states around us since he’s been in office.” –State Sen. Steve McClure (R-Springfield)

“Ask an educator if the budget does what is needed for our students and the answer will be ‘no.’ Any math teacher can look at the state’s budget and tell you, we need to tax the ultra-rich in Illinois to give children the schools they deserve from pre-k to Phd, to make our state number one in education, and to take the burden off the backs of Illinois’ working families. And any history teacher will tell you now is the moment to do it without delay. The Governor and lawmakers have a choice in his ‘maintenance budget’ to maintain inequality and giveaways to billionaires or to help Illinois’ working families who are struggling to maintain under higher costs and fewer supports.” — Illinois Federation of Teachers, excerpt

“We recognize the significant fiscal pressures facing the state and commend Gov. JB Pritzker for his continued focus on a disciplined approach, including the creation of spending reserves and focus on improving our state’s credit rating. We also applaud his plan to create the EDGE Essentials program to support grocery stores and pharmacies in underserved communities. Expanding resources that help these essential businesses invest, operate, and serve residents is a meaningful step, and we encourage lawmakers to build on this effort. At the same time, we have serious concerns with proposals to impose a tax on digital advertising when retailers are already facing rising operating costs and intense competition. Retailers, especially small businesses, rely on affordable digital tools to reach new consumers and grow, and this proposal risks undermining local businesses and the communities they serve. We look forward to working with the Governor and legislative leaders to support Illinois retailers while prioritizing fiscal stability.” — Rob Karr, CEO, Illinois Retail Merchants Association

“The Illinois Chamber of Commerce appreciates Governor Pritzker’s FY27 Budget Recommendation that seeks to address many of today’s economic challenges. We understand that balancing a budget requires making tough decisions with limited resources. However, this budget proposal contains several concerning provisions that send the wrong signal to existing Illinois businesses and those seeking to locate here. The Chamber certainly shares the Governor’s desire to build more housing, spur nuclear energy development to lower the cost of energy for consumers, and invest in vocational training programs. Unfortunately, the Governor’s proposal also relies on policies that could have negative impacts on business development, cost of living, and overall tax burden on Illinois job-creators.” — Illinois Chamber of Commerce, excerpt

“Illinois has always been on the forefront of innovation, from the origination of nuclear power and the creation of the cell phone, to the development of life-saving therapies and the establishment of the nation’s largest quantum computing project. Manufacturers are proud to be a big part of that legacy, and we’re encouraged by efforts to maintain the momentum by investing in our workforce, streamlining permitting processes and increasing production of reliable, affordable energy. In order to truly foster an innovation economy, we must remain focused on supporting businesses and job creators seeking to locate and grow in Illinois, not putting up new barriers to entry in the form of higher taxes, more regulations, and fewer incentives. It’s also critical that Illinois live within its means. While this budget proposal largely holds the line on new spending, it comes amid efforts by the legislature to add billions of dollars in higher taxes that will fuel new spending – most of which will be funded by job creators, which increases costs on consumers and makes it more difficult for businesses to hire and grow. We look forward to working collaboratively with the Governor and General Assembly to ensure Illinois remains competitive and on the cutting-edge of technological advancement and economic investment.” — Mark Denzler, CEO, Illinois Manufacturers Association

“Today’s speech from JB Pritzker was nothing more than empty promises, hypocrisy and fearmongering. For the last eight years, Pritzker and Illinois Democrats have relied on massive tax increases, financial gimmicks and out-of-control spending to pass a budget. Again, this year relies on, yet another massive spending package filled to the brim with tax increases that will only hurt Illinois families and small businesses. The only solution is to enact commonsense, responsible, conservative policies to cut our bloated spending and get our finances under control.” — Kathy Salvi, Chair, Illinois Republican Party

“The Illinois Clean Jobs Coalition welcomes the Governor’s proposal to pause the data center tax credit as the General Assembly looks to take holistic action this Spring to protect consumers from skyrocketing electricity bills. As data centers continue to consume massive amounts of electricity and water while bringing pollution to our doorsteps, it is critical we reassess this industry, its impacts on Illinois, and the taxpayer handouts offered to them, which as of the end of 2024 totalled close to $1 billion in tax benefits.” — Illinois Clean Jobs Coalition, excerpt